Ever caught yourself dreaming about a fancy sports car, vacationing in the Maldives, or living in a house with a gorgeous beach view (just to name a few)?

If this is you, make your dream a reality and start a habit journal.

1. What are your Financial Objectives?

First, you need to determine what your short-term and long-term financial goals are:

Short-term goals could be:

Save $500 a month.

Stick to a monthly budget of $2,500.

Limit shopping to $100 each month.

Long-term goals could be:

Paying an extra $5,000 of my student loan this year.

Saving $4,000 in 8 months for a Christmas family vacation.

Saving $30,000 over 3 years for a house down payment.

Determining your personal goals can help you budget more effectively.

2. Choose the Right Journaling Materials

Having the right material for your journaling is very important.

Pick something that is functional or beautiful, according to your preferences. This can help you continue this habit journal for a long period of time.

Tool options:

phone apps

online graphic design platform, such as Canva

paper journal

Excel spreadsheet

3. Format your Journal

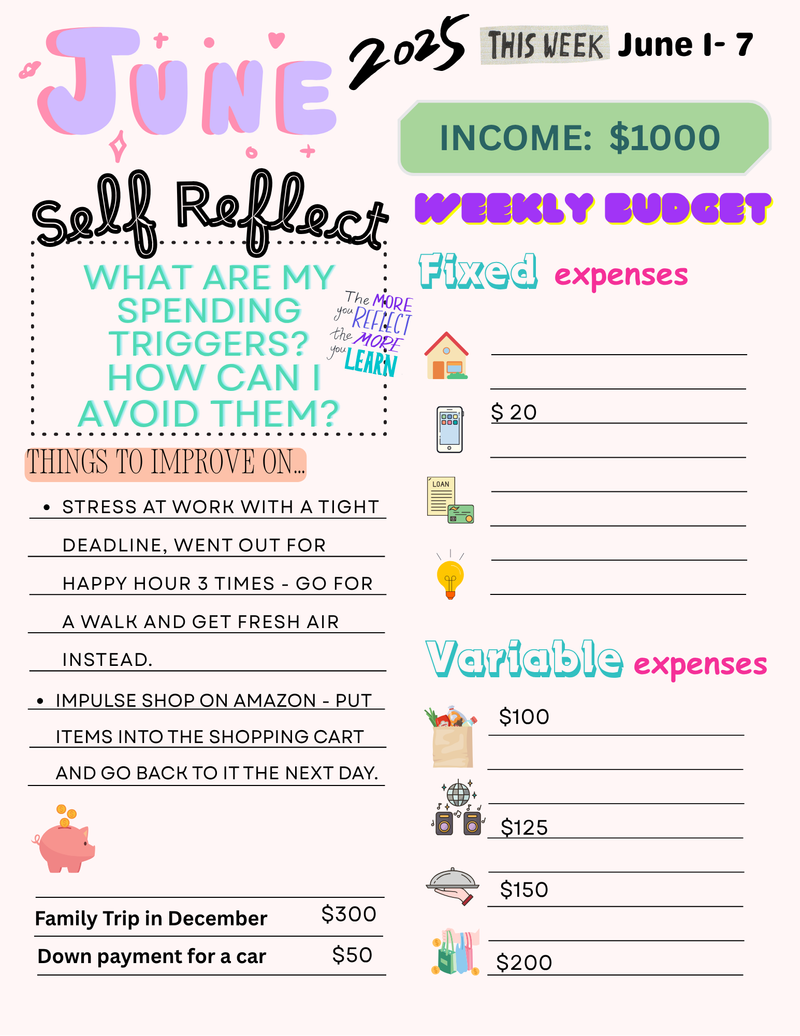

Organize your habuit journal to fit your financial goals. Use a daily, weekly, or monthly tracker.

Be sure to include:

Monthly income: total income post-tax deduction.

Expenses: divide them into 2 subsections of fixed and variable expenses. Then categorize them into individual sections such as transportation, housing, and food.

Fixed expenses such as:

mortgage

rent

cellphone bill

loan payments.

Variable expenses such as:

grocery

shopping

takeout/eating out

entertainment

Saving goals: Monthly savings put aside for your financial goals. Include subsections if you have more than one saving goal.

4. Include Journal Prompts

A good habit journal prompt is a thought-provoking question or a statement that will inspire self-reflection. It is a powerful tool to reflect and gain a deeper understanding of your money mindset.

Examples:

What are my spending habits? What can I improve on?

What are my spending triggers? How can I avoid them?

Photo by Gabrielle Henderson on Unsplash

Photo by Gabrielle Henderson on UnsplashKnowledge check:

What are some good journal prompts? Select all that apply.

What positive affirmations can improve my money mindset?

Why are my short-term and long-term goals important to me?

How much did I save this week?

I need to order fewer Uber Eats this week!

Quiz

What are some good habit journaling prompts?

5. The Final Look

Here is an example of how you can build your own weekly habit journal by using Canva platform.

A prompt for self reflection.

Journaling your thoughts from the prompt.

Format your journal from step #3 by including your weekly income, weekly fixed and variable expenses, and weekly saving goals that reflect back to your financial goals.

To hear an audio version of the information in the image above, click the play button on the audio player below:

To hear an audio version of the information in the image above, click the play button on the audio player below:

6. Make it a Habit

Keep journaling!

Set up a time: set a reminder on your phone to do your habit journal daily or weekly.

Make it a ritual: set the scene by lighting a candle or listening to music.

Start small and be consistent: journaling can be short. Start with 5 minutes a day

or 15 minutes once a week. Consistency is key for your habit journal.

Take Action

Your feedback matters to us.

This Byte helped me better understand the topic.